RSBC group

We are a Czech investment group. We have been growing the capital entrusted to us by our partners since 1998.

We focus on projects that are exceptional in some way, whether through growth dynamics, production programmes, or market position. We regard profit generation as a fundamental investment principle, while also emphasising the importance of building strong relationships and lasting values.

OUR PRINCIPLES

- portfolio diversification

- long-term stability

- growth built on solid foundations

- exceptional opportunities

- active engagement in strategic management

Real Estate

- real estate investment strategy for the group, the real estate fund, and financial partners

- management of real estate acquisitions and divestments

- maximisation of the value of assets under management

- complete legal, financial, and technical know-how

CZK 3.1 bn

market value of the portfolio managed

7 projects

under management

95+%

tenant occupancy rate

68,600 m²

total leasable area

Private Equity

-

identification and assessment of investment opportunities

-

acquisition of companies, their management, and subsequent preparation for sale

-

strategic assets under long-term maintenance and management

-

co-investments with RSBC and a group of managed funds

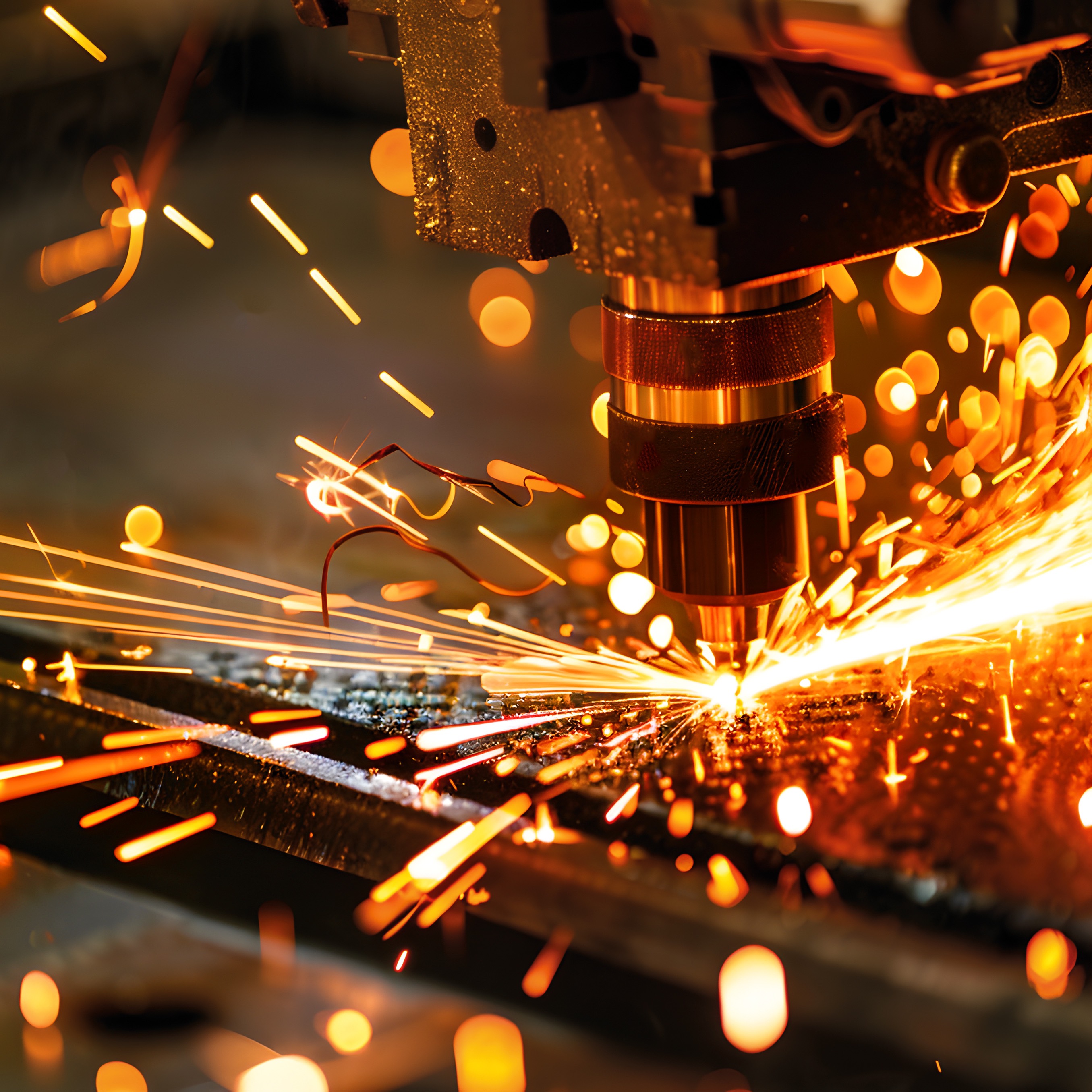

Defence

AREX, STEYR ARMS, VERNEY-CARRON

Logistics

PJ Expedis (CZ) – servicing mobile operators in the Czech Republic and Slovakia

Other

Investment Funds

The funds’ strategy is to actively seek out opportunities and co-finance RSBC investments. The aim is to identify attractive opportunities and provide flexible financing that facilitates superior returns while minimising excessive risk.

PREMIUM REAL ESTATE

8,6 %

average anual return since inception (07/2020–12/2024)

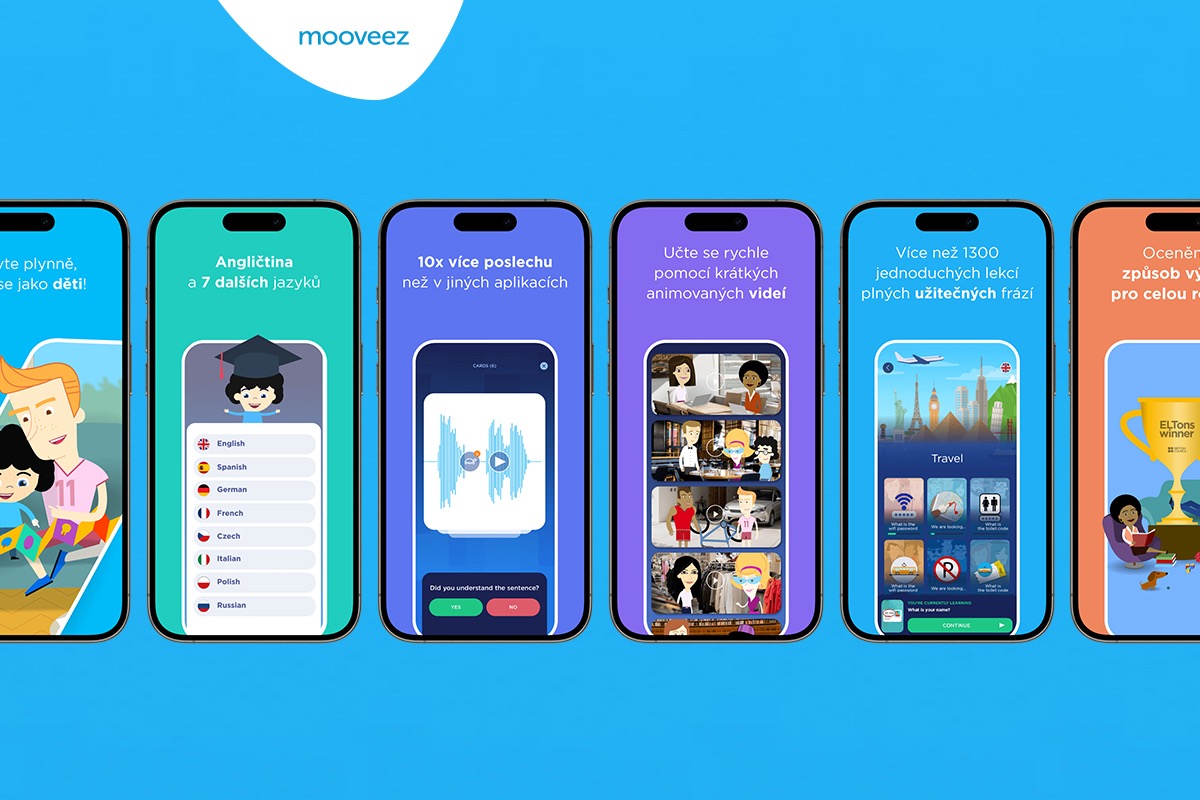

RSBC DEFENCE

9–11% p.a.

the gross targeted annual return

Wealth management

Sustainable management of client assets across all asset classes through Schönfeld & Co Wealth and Asset Management.

Asset management

Comprehensive management of all client asset classes

Family constitution

Family structure setup

Family prestige

Social and influential status of the family in the long term

Investment company

Profit license Q3/2024